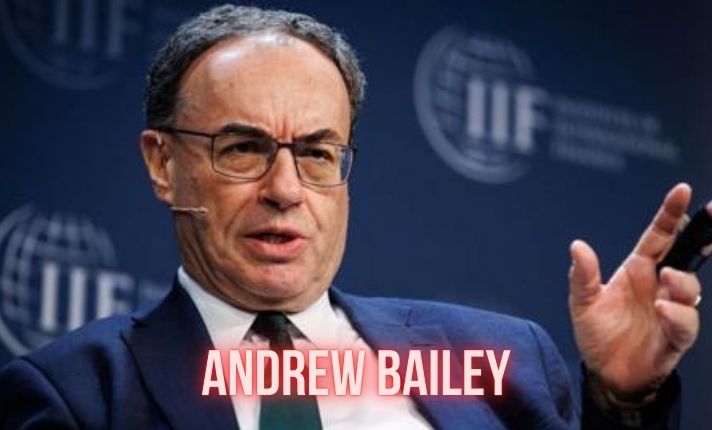

A veteran central banker and regulator, Andrew Bailey has spent four decades shaping UK and global financial policy. As Governor of the Bank of England and, from July 2025, Chair of the Financial Stability Board, Bailey’s decisions affect monetary policy, financial stability and regulatory norms worldwide.

- Quick Bio

- Early Life & Origin Story

- Career & Rise to Fame

- Key Achievements & Institutional Impacts

- What is Andrew Bailey’s Net Worth?

- Personal Life & Relationships

- Controversies

- Leadership Style & Policy Philosophy

- Public Speeches & Notable Positions (2024–2025)

- Why Andrew Bailey Matters — Legacy & Influence

- Gaps, Uncertainties & Sources

- Conclusion

- FAQs

Quick Bio

| Fact | Details |

|---|---|

| Full Name | Andrew John Bailey |

| Age | 66 |

| DOB | 30 March 1959 |

| Net Worth | ~£5,000,000 (public estimates, 2025) |

| Height | ~180 cm (public profile estimates) |

| Spouse / Partner | Cheryl Schonhardt-Bailey |

| Ethnicity | British / English |

| Source of Wealth | Public-sector salary (Bank of England), pension benefits, decades in senior regulatory roles |

| Education | Queens’ College, Cambridge — BA (History), MA, PhD (Economic History); Wyggeston Boys’ Grammar School, Leicester |

Early Life & Origin Story

Andrew John Bailey was born in Leicester on 30 March 1959. He attended Wyggeston Boys’ Grammar School before reading history at Queens’ College, Cambridge. At Cambridge he specialized in economic history and later completed a PhD on the industrial and economic effects of the Napoleonic Wars in the Lancashire cotton industry.

A formative turning point came in graduate study: rather than following a conventional economics or finance track, Bailey’s immersion in economic history trained him to look for structural causes and long-run patterns. That intellectual background shaped a methodical approach to policy: evidence-driven, cautious, and attentive to systemic linkages — traits that recur throughout his career.

After Cambridge, Bailey took a short research post at the London School of Economics (LSE) before joining the Bank of England in 1985. That move set the course for a professional life inside the machinery of central banking and financial regulation.

Career & Rise to Fame

Andrew Bailey’s rise was steady, technical and institutional. He progressed through policy and operations roles before moving into regulatory leadership.

- Early Bank roles (1985–1996): Joined the Bank of England in 1985. Early assignments included international capital markets, developing-country debt and banking supervision policy. He built technical expertise in monetary analysis and banking operations. (Bank of England biography; public CV.)

- Private Secretary to the Governor (1996–1999): Served as Private Secretary to the Governor of the Bank of England — a senior advisory and coordination role that exposed him to top-level policy processes. (Bank of England CV.)

- Head of International Economic Analysis (1999–2003): Led the International Economic Analysis Division within Monetary Analysis, giving him exposure to global macro issues and research that feed into rate decisions. (Bank of England CV.)

- Chief Cashier & Executive Director, Banking Services (2004–2011): As Chief Cashier, his signature appeared on Bank of England banknotes. As Executive Director for Banking Services he managed core operational functions and cash infrastructure. (Bank of England CV.)

- Special Resolution Unit (2007–2011): Led the Bank’s Special Resolution Unit through the 2008 financial crisis, managing bank failures and continuity arrangements. He was central to resolution planning and crisis responses. (Bank of England CV; public reports.)

- Dunfermline Bridge Bank (2009): Chaired and acted as chief executive of the resolution vehicle created to wind down the failed Dunfermline Building Society, a practical application of the SRU’s remit. (Public records.)

- FSA / Prudential roles (2011–2013): Joined the Financial Services Authority (FSA) as Deputy Head of the Prudential Business Unit and Director responsible for UK banks and building societies. Later became Managing Director for the prudential business. (FSA/Bank of England records.)

- Prudential Regulation Authority (2013–2016): On 1 April 2013 he became the first Deputy Governor for Prudential Regulation and Chief Executive of the newly created Prudential Regulation Authority (PRA) at the Bank of England. He built the PRA during a period of post-crisis reform. (PRA/BoE announcements.)

- Financial Conduct Authority (2016–2020): Appointed Chief Executive of the Financial Conduct Authority (FCA) on 1 July 2016. The role placed him at the centre of conduct regulation, consumer protection and market oversight. (FCA/BoE announcements.)

- Governor of the Bank of England (2020–present): Appointed Governor on 16 March 2020, succeeding Mark Carney. He assumed the role as the COVID-19 pandemic hit global markets, making crisis management and stabilisation immediate priorities. (UK government and BoE announcements.)

- Chair, Financial Stability Board (2025–present): In 2025 he was nominated and then confirmed as Chair of the Financial Stability Board (FSB), beginning a three-year term on 1 July 2025. This expanded his remit from UK regulation to global financial stability coordination. (FSB announcements; Reuters coverage.)

Bailey’s résumé is notable for breadth: operations, monetary analysis, crisis resolution and prudential supervision. The sequence — from detailed technical desks to chief executive positions — built a reputation as a problem-solver with deep institutional memory.

Key Achievements & Institutional Impacts

- Built and operationalised the Prudential Regulation Authority after the 2008 reforms, creating a long-term prudential framework for UK banks and insurers.

- Led the Special Resolution Unit during the 2007–2011 period, contributing directly to resolution plans and interventions that managed failing institutions.

- As FCA CEO, oversaw multiple consumer-facing reforms and enforcement cases; his tenure included high-profile investigations into market conduct and consumer remedies.

- As Governor, steered the Bank through the immediate economic fallout of the pandemic, Brexit-related shocks, and a high-inflation cycle that required an active stance on monetary policy.

- As FSB Chair, positioned to coordinate global responses to systemic risks, including private credit growth, AI-driven valuation complexities, and the cross-border effects of macro-policy divergence.

What is Andrew Bailey’s Net Worth?

Publicly verifiable data on personal wealth for senior public servants is limited. Net-worth estimates appearing in the public domain typically combine salary disclosures, pension entitlements and cumulative career earnings. Key points:

- Remuneration (2024/25): Official Bank of England reporting indicates total remuneration (base salary, pension substitution and taxable benefits) of about £598,074 for the 2024/25 reporting year. (BoE annual report.)

- Public estimates (2025): Commercial “net-worth” profiles estimate his wealth around £5 million. Those estimates are based on public pay, pensions and simple accumulation models. They are not verified by independent audits or detailed asset declarations. (Independent net-worth profile sites; public estimates.)

- Asset profile: There is no public evidence of large private equity holdings, business ownership or other opaque wealth sources. The simplest and most supportable explanation is that his net worth is primarily the result of public-sector salaries, long service pension benefits and conservative personal savings/investments.

Caveat: net-worth websites frequently use opaque methodologies. For a public-sector official like Bailey, the most reliable numbers are official pay disclosures and pension substitution data; any larger net-worth figure should be treated as an estimate rather than fact.

Personal Life & Relationships

Andrew Bailey is married to Cheryl Schonhardt-Bailey, a professor of political science (notably affiliated with the London School of Economics). The couple has two children.

- Cheryl Schonhardt-Bailey is known for academic work in political science and public opinion research. Their marriage and professional pairing are often referenced as an example of two public-facing careers in adjacent fields of policy and academia.

- Bailey keeps his private life deliberately low profile. Limited public reporting suggests he maintains modest personal habits and does not court publicity.

This reserved public profile aligns with his professional persona: measured, discreet and institutionally focused.

Controversies

Throughout a long public career, Bailey has attracted critique common for regulators operating at the intersection of politics, markets and public expectations. Notable issues include:

- FCA criticisms and “asleep at the wheel” allegations: During and after his tenure as FCA CEO, critics argued the regulator was slow or insufficiently forceful in some high-profile sector failures and mis-selling cases. A widely circulated claim that he fell asleep in a meeting with campaigners became a flashpoint for parliamentary scrutiny; the episode was used by critics to symbolise perceived regulatory slowness. (Press coverage and Parliamentary exchanges.)

- Regulatory decisions and senior ban cases: Regulatory actions taken under Bailey’s FCA leadership, including restrictions on senior bankers, have provoked legal and political pushback. For example, the regulatory scrutiny that led to sanctions or professional restrictions for senior executives has been characterised by some as heavy-handed or consequential for careers; defenders point to the need for robust enforcement to protect markets. (Newspaper reporting; legal filings.)

- Climate and nature risk supervision concerns (2025): Some departing Bank of England staff involved in climate and nature risk supervision publicly argued that such issues were being deprioritised in favour of traditional financial risk metrics. Those staff departures and commentaries raised questions about the Bank’s balance between systemic climate risks and conventional prudential oversight. (Financial Times coverage.)

- Political tensions over deregulation: Bailey has publicly warned against rapid deregulation and argued for retention of post-2008 safeguards. This stance put him at odds with parts of government and business that advocated lighter regulatory burdens to stimulate growth. Such tensions are part of a broader institutional debate about the trade-offs between stability and dynamism. (Reuters; other press statements.)

When assessing controversy, it is important to distinguish between documented regulatory actions and partisan critiques. Regulators are routinely subject to political pressure; scrutiny is part of democratic accountability. The record shows both factual enforcement steps and politically charged interpretations of those steps.

Leadership Style & Policy Philosophy

Bailey’s leadership style is commonly described as calm, methodical and evidence-based. Several themes characterise his approach:

- Institutional memory: With over 40 years inside the Bank of England and related institutions, Bailey draws on deep organisational knowledge. That background shapes cautious, system-wide thinking.

- Stability-first orientation: He prioritises financial stability and prudential safeguards, reflecting lessons from the 2008 crisis. He has repeatedly argued that there is little trade-off between stability and sustainable growth over the long term.

- Technocratic posture: He focuses on data, stress tests and scenario analysis. Public speeches emphasise measured, incremental adjustments rather than abrupt policy swings.

- Global coordination: As FSB Chair, he emphasizes the need for multilateral coordination to manage cross-border risks — from private credit expansion to technological changes in finance.

Public Speeches & Notable Positions (2024–2025)

A few public stances illustrate Bailey’s contemporary priorities:

- Cautious approach to rate cuts: In 2025 he signalled a gradual approach to easing monetary policy, warning that the path should be cautious given geopolitical and trade risks. (BoE speeches; press coverage.)

- Warning against complacency about 2008 lessons: He has frequently reminded policymakers that reforms since 2008 reduced systemic risk; backing away from those reforms too quickly could be hazardous. (Public speeches; Reuters coverage.)

- Calls for banks to use capital flexibly: Following a 2025 decision to reduce capital-buffer requirements after stress-test pass rates, he urged banks to channel freed capital into lending to households and firms to support growth. (BoE/Reuters coverage.)

- Global economic fragmentation risk: He warned that rising tariffs and trade fragmentation risk undermining the integrated global economy, urging cooperative responses. (FSB/BoE speeches; press summaries.)

Why Andrew Bailey Matters — Legacy & Influence

Bailey’s significance stems from three linked facts: tenure, institutional roles and timing.

- Tenure and continuity: Four decades inside the Bank and related regulators provide a rare continuity of knowledge.

- Cross-cutting roles: He has led both prudential (PRA) and conduct (FCA) authorities, then the central bank. That combination gives him an unusually broad view of finance.

- Crisis leadership: He assumed the Governorship at the outset of the COVID-19 shock and has since navigated high inflation, Brexit aftershocks and shifts in global financial plumbing.

His 2025 elevation to FSB Chair amplifies his reach. The FSB coordinates international regulatory frameworks; leading it at a time of new systemic risks (private credit, AI-linked market structures, geopolitical fragmentation) means Bailey will influence rules that shape global finance for years.

Gaps, Uncertainties & Sources

- Net worth precision: Public estimates (~£5m) are not independently audited. Reliable figures are limited to official salary and pension substitution disclosures. Treat private net-worth figures as approximations.

- Attribution of policy outcomes: The consequences of regulatory or monetary decisions reflect many actors. It is difficult to isolate individual causal impact in complex macro and regulatory environments.

- Recent internal dynamics (climate supervision resignations): Reporting on staff departures and internal prioritisation reflects an evolving policy debate; full institutional accounts and follow-up reviews may be required to fully assess claims.

Primary public sources used for this draft: Bank of England official biography and annual reports; Financial Stability Board announcements; major news outlets including Reuters, Financial Times and The Guardian; public FSA/FCA records; and public domain biographical summaries.

Conclusion

Andrew Bailey’s career is a study in institutional expertise applied to recurrent crises. He combines operational experience, prudential authority and market conduct oversight in a single professional trajectory. As Governor of the Bank of England and Chair of the Financial Stability Board, his remit now spans domestic monetary and prudential policy to global coordination on systemic risk.

Bailey’s practical, stability-first philosophy has both defenders and critics. Supporters point to strengthened safety nets since 2008 and the need for slow, evidence-based change. Critics argue regulators must act more forcefully on consumer harms or new risks such as climate. Either way, his decisions will shape UK and global finance through the rest of the 2020s.

FAQs

Who is Andrew Bailey?

Andrew Bailey is the Governor of the Bank of England and a long-time UK financial regulator.

How old is Andrew Bailey?

He is 66 years old (born 30 March 1959).

What is Andrew Bailey’s net worth?

Public estimates place his net worth at around £5 million in 2025.

What is Andrew Bailey’s salary?

As Bank of England Governor, he earns approximately £495,000 annually.

Who is Andrew Bailey married to?

He is married to academic and political scientist Cheryl Schonhardt-Bailey.

What is Andrew Bailey known for?

He is known for leading the Bank of England during the COVID-19 crisis and high-inflation period of the early 2020s.

Where did Andrew Bailey study?

He studied at Queens’ College, Cambridge, earning a BA, MA and PhD in Economic History.

What positions did Andrew Bailey hold before becoming Governor?

He previously led the FCA, PRA, and served as the Bank of England’s Chief Cashier.